Lower-Priced Products Such As Apple’s $329 iPad Slow Tablet Market Decline In Second Quarter; Relief Likely Temporary – IDC

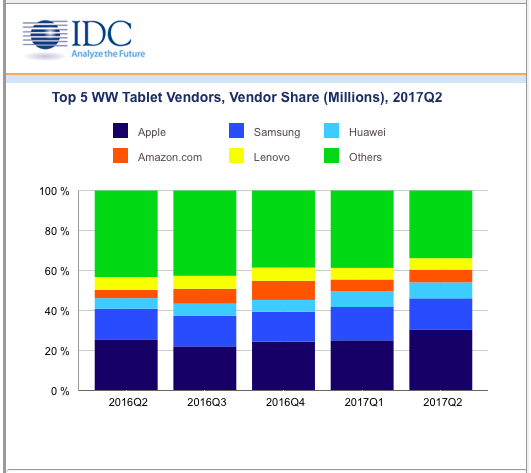

The tablet market’s downward spiral continued in 2017’s second quarter (2Q17), according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker. Despite notable product launches like the new lower-priced iPad and products from other top-tier vendors, worldwide shipments for tablets declined 3.4% year over year in 2Q17, reaching 37.9 million.

Once touted as the market’s savior, detachable tablet sales also declined in the second quarter as consumers waited in anticipation of product refreshes from high-profile vendors like Apple and Microsoft. However, with new product launches towards the end of the second quarter, the detachable market is expected to maintain a stronger position in the year’s second half.

“There’s been a resetting of expectations for detachables as competing convertible notebooks offered a convincing and familiar computing experience for many,” said Jitesh Ubrani, senior research analyst with IDC’s Worldwide Quarterly Mobile Device Trackers. “To date, the 2-in-1 market was bifurcated as Apple and Microsoft led with detachables while the PC vendors led with convertibles. Though that is slowly changing as smartphone vendors and traditional PC vendors begin to offer compelling alternatives, the pace has been rather slow as Surface and iPad Pro still dominate shelf space and mindshare.”

Market turmoil aside, three of the top five vendors, including Apple managed to increase share and grow on a year-over-year basis with price being the largest driving factor. However, IDC warns that these gains may be temporary as the replacement cycle of tablets is still long (closer to traditional PCs rather than smartphones) and first-time buyers have become a rare commodity. With downward pressure on pricing from big name brands, “whitebox” tablet vendors and smaller brands are starting to turn their attention away from tablets and IDC expects this trend to continue.

“The tablet market has essentially become a race to see if the burgeoning detachables category can grow fast enough to offset the long-term erosion of the slate market,” said Linn Huang, research director, Devices & Displays at IDC. “From that lens, the second quarter was a slight righting of the ship and there is still much to be hopeful about in the back half of 2017. New product launches from Microsoft and Apple are generally accompanied by subsequent quarters of inflated shipments, the reintroduction of Windows to the ARM platform could help remedy the aforementioned hollowing of the middle of the market, and we expect a proliferation of Chrome OS-based detachables in time for the holidays.”

Tablet Company Highlights

Apple positioned itself quite well during the quarter by consolidating its lineup and introducing two new iPads. The new 9.7-inch iPad’s relatively low price $329 price point persuaded some consumers to upgrade their aging devices and demand for this new tablet finally caused a breakthrough turnaround for Apple’s iPad business which had been in seemingly relentless decline for more than three years. iPad sales of more than 11.4 million units in the quarter, represented a substantial 15 percent year-over-year increase in units shipped were particularly noteworthy, although iPad revenues increased by only a modest two percent, indicating that most of the growth was from the new $329 base 9.7-inch iPad released in March. Meanwhile Apple’s transition towards detachable tablets continued with the launch of the 10.5″ iPad Pro in June and a major update to iOS 11 expected later this year.

Samsung was able to gain share simply by sustaining flat growth in this declining market. The company appears to be the third major contender in detachables, after Apple and Microsoft, and in typical Samsung fashion offers multiple detachable tablets with a choice of either Windows or Android. On a worldwide basis, Samsung’s slates have a significant presence though, like many other vendors, this portion of the business continues to struggle.

Huawei’s investment in brand marketing in Europe and Asia has continued to work well as the company finds itself among the top 5 for tablets as well as smartphones. With plenty of low-cost and cellular-enabled options, Huawei has been able to slowly steal share from rivals like Lenovo. However, the company has been fairly cautious of the detachable market and recent products have had very limited launches.

Amazon.com’s aggressive pricing strategy has worked well due to its ever-growing ecosystem. Amazon also managed to update its lineup, offering new tablets at a better price and expanding its Alexa service to the UK. Amazon is also the only major vendor that actively targets the kids’ tablet market by offering a dedicated bundle inclusive of kid-friendly content an approach that seems to have paid off as the company has managed to maintain a stronghold in the tablet market.

Despite the annual decline, Lenovo has managed to slowly increase the share of detachable tablets within its product portfolio, which tend to have a higher average selling prices (ASPs). A low-cost strategy focused on Asia has worked so far, but that strategy is starting to lose its legs.

Notes:

• Total tablet market includes slate tablets plus detachable tablets. References to “tablets” in this release include both slate tablets and detachable devices.

• “Convertibles” refers to convertible notebooks, which are notebook PCs that have keyboards that can either flip, spin, or twist, but unlike detachable tablets, convertible notebook keyboards are hardwired to the display.

• Data is preliminary and subject to change.

• Company shipments are branded device shipments and exclude OEM sales for all companies.

• The “Company” represents the current parent company (or holding company) for all brands owned and operated as subsidiary.

For more information, visit:

http://www.idc.com

Source: International Data Corporation (IDC)