iPhone Dominates, iPad Languishes, MacBooks Buck PC Sales Slump – The ‘Book Mystique

A major report last week by Above Avalon’s Neil Cybart contends that “The iPhone is Taking Over Apple” to a degree that the company’s other products hardly matter The Apple watcher financials and market analysis blogger notes that the iPhone’s “gravitational pull” is now simply too strong for any new Apple product or service to have any realistic hope of building up escape velocity to become the next big thing for Apple in the near-term.

I suppose that many fans of other Apple hardware devices sometimes feel like poor relations with regard to the amount of attention the iPhone gets. I have great respect and admiration for the iPhone, but for me a cellphone is primarily a phone, and other than in emergencies, I have zero interest in using a smartphone — even a phablet like the iPhone 6 Plus — as a PC surrogate productivity device, and even less as a T.V. or movie watching medium.

For me, the top interest hand-holdable Apple device is the iPad, the mini version of which represents about my bottom limit of screen dimensions for a serious productivity device. I use a 9.7-inch iPad Air 2 as my portable workhorse, and find I spend about half of my screen time on the iPad, the other half on my Macs, which I prefer in just about all ways save for the iPad’s sublime ease of use almost anywhere.

Cybart maintains convincingly that from a financial and business perspective, the iPhone is the only product that matters to Apple, and that it has amassed so much market power it’s difficult to imagine any other product being able to dramatically surpass the iconic handset in terms of importance over the next five years.

He observes that Apple will be “the iPhone company” for the foreseeable future, a state of affairs that presents both opportunities and risks for Apple to navigate over the coming years.

Putting the now eight-year-old iPhone into perspective, Cybart cites:

• 726 million iPhones sold

• $443 billion of revenue (50% of total)

• $200 billion of gross profit (60% of total)

• $120 billion of net income (60% of total)

Cybart notes that Apple is continuing to build iPhone momentum, and is now selling up to 250 million iPhones a year, or close to a third of total iPhones sold to date. He observes that while everyone knows the iPhone is a crucial part of Apple’s business, few realize the extent to which the iPhone is taking over Apple’s financials. For example, in the first half of FY2015 it accounted for 69 percent of Apple’s total revenue, up from an already lopsided 57 percent of revenue during the same time period in 2014. In terms of gross profit, the trend is even more pronounced, with iPhone accounting for 81 percent of Apple’s gross profit over the past two quarters, up from 68 percent year-over-year.

Behind this remarkable phenomenon are the iPhone’s strong margins and a typically short upgrade cycle, with iPhone users likely to upgrade their high-margin phones every two or three years, unlike with say, iPads or laptops, which lead more sheltered lives physically, and where advances in technology and features have been leisurely enough that many users are extending upgrade cycles to four or five years or even more. Case in point; the late 2008 MacBook I’m typing this blog on right now is six years old and still going strong.

For the full Above Avalon iPhone report, visit:

http://www.aboveavalon.com/notes/2015/7/5/the-iphone-is-taking-over-apple

iPad: Too Good For Its Own Good?

So what of the iPad, of which not much has been said lately? A brief overview of what’s likely happening in the near term is look for the original iPad Air, and the original iPad mini and mini 2 to be end-of-lifed, with the Air 2 and mini 3 expected to fill the role of entry-level iPads after new Air 3s and mini 4s debut in mid-late October — probably with A9 processors, and a 12.3-inch iPad Pro is widely anticipated in calendar Q4/15 or 1H/16.

Last week, BusinessInsider released a 17-page Tablet Market Report, which finds that the tablet market has “hit a wall,” with sales growth not only slowing, but tablet shipments now having contracted for the second consecutive quarter of 2015, declining six percent year-over-year.

Business Insider’s Tony Danova notes that as recently as 2011, annual global tablet shipments growth hit 305 percent, but that by 2014, just three years later, total tablet shipments growth had slowed to just eight percent, and even more in 2014 to negative six percent.

Access to the full report will cost you $395.00, but Danova has posted some exemplary highlight points in a blog, here.

He notes that BI Intelligence have revised down their tablet shipments projections for what was once the fastest-growing consumer electronics category, now estimating “very modest annual growth over the next five years, driven by enterprise uptake and low-cost device sales.”

The analysts now expect global tablet shipments to record only a 2.5 percent compound annual growth rate (CAGR) between 2015 and 2020, reaching just 281 million units by the end of the forecast period.

Danova also observes that iPad shipments have declined for five consecutive quarters, and in Q1/2015, they were down 23 percent YoY, the paradigm-setting product’s worst quarterly decline ever.

Meanwhile, the tablet market is being overrun by generic, low-cost devices, with these so-called “white-box” tablets now accounting for 43 percent of tablet shipments overall.

Danova proposes that the enterprise is now the tablet’s “last-chance market”, but it maintains that even if enterprise ventures like Apple’s alliance with IBM to develop and market business oriented MobileFirst software for Apple’s iOS devices, that won’t completely reverse the generally negative outlook for the device, projecting that tablets will make up only four percent of total enterprise device activations by 2018, even after growing faster than all other enterprise device segments.

He points out that even in a more-than-ordinarily tablet-friendly market like the US, tablet penetration in the enterprise is minimal, with just 18 percent of companies claiming they have tablets deployed, albeit with another 50 percent affirming plans to do so this year.

The upshot seems to be that while the iPad and other tablets aren’t going to disappear anytime soon (a la Apple’s erstwhile Newton for instance), their modest growth prospects don’t provide Apple with much incentive to develop more new features like the multitasking capabilities that they’ve added to iOS 9. Speaking of which, one big advantages of the iPad sharing a largely common operating system with the iPhone is that development of iPhone features ms upgrades is a priority, and the iPad gets pulled along with most of them.

MacBooks Defy PC Sales Downdraft

That said, if, hypothetically speaking, Apple did discontinue the iPad at some future date, I would be sad to see it go, but could get along fine with a small laptop like the 11-inch MacBook Air or the new 12-inch Retina MacBook as my mobile productivity device. I’m still a laptop guy at heart, and the good news is that Apple notebook computers are doing quite well these days, in fact leading the category in a soft market according to the latest market analytics from IDC and Gartner Inc.

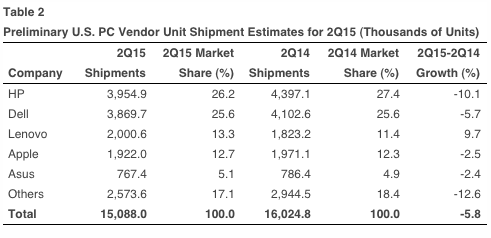

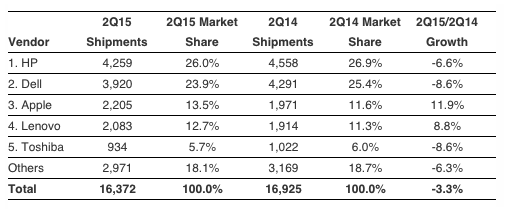

IDC reported late last week that with shipments totalling nearly 16.4 million PCs in 2Q15, the U.S. personal computer market shrank 3.3 percent from its performance in the same quarter a year previous. However, while most PC vendors suffered volume decline, gains from still robust sales of Apple and Lenovo systems helped limit the overall decline. One factor helping Apple and Lenovo to buck the trend was the two companies’ respectively strong emphasis on laptop PCs, since IDC notes that desktop shipments continued to decline year-over-year while portable PC shipments continued to grow proportionately.

IDC notes that Apple continued to outperform other vendors, with growth of 16.1 percent globally, while largely avoiding the price competition affecting other players, and may also be benefiting from some of the uncertainty around the launch of Windows 10, along with refreshed products like the 12-inch MacBook and a relative concentration of shipments in the U.S. with its improving economic environment.

IDC says Apple is now a solid number 3 in domestic sales, behind only HP and Dell, with 13.5 percent of the U.S. PC market.

Top 5 Vendors, United States PC Shipments, Market Share, and Year-Over-Year Growth, Second Quarter of 2015

(Preliminary) (Shipments are in thousands of units)

Source: IDC Worldwide Quarterly PC Tracker, July 9, 2015

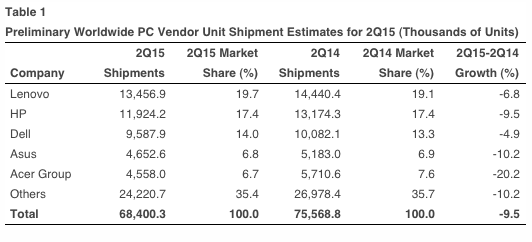

Gartner, on the other hand has Apple in fourth place in its home market with a 12.7 percent share.

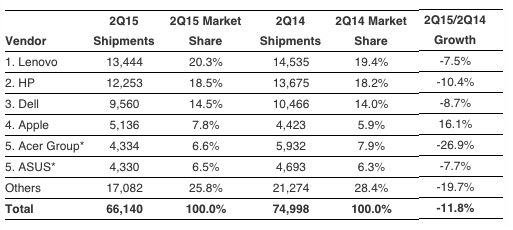

As for global market metrics, IDC ranks Apple in fourth place globally with a 7.8 percent share of the overall laptop pie, and outpacing Acer and Asus.

Top 5 Vendors, Worldwide PC Shipments, Market Share, and Year-Over-Year Growth for the Second Quarter of 2015

(Preliminary) (Shipments are in thousands of units)

Source: IDC Worldwide Quarterly PC Tracker, July 9, 2015

Gartner again says otherwise, ranking Apple behind both Acer and Asus, in the 35.4 percent of the worldwide market designated “other.

Looking ahead to the second half of 2015, which we are now in, the slow PC shipments were largely anticipated as a result of stronger year-ago shipments relating to end of support for Windows XP as well as the channels reducing inventory ahead of the Windows 10 release. In addition, weaker or changing exchange rates for foreign currencies have effectively increased PC prices in many markets, thereby reducing purchasing power and complicating investment planning.

“Although the second quarter decline in PC shipments was significant, and slightly more than expected, the overall trend fits with expectations,” said Loren Loverde, IDC Vice President, Worldwide PC Trackers & Forecasting. “We continue to expect low to mid-single digit declines in volume during the second half of the year with volume stabilizing in future years. We’re expecting the Windows 10 launch to go relatively well, though many users will opt for a free OS upgrade rather than buying a new PC. Competition from 2-in-1 devices and phones remains an issue, but the economic environment has had a larger impact lately, and that should stabilize or improve going forward.”

“The U.S. market was in line with forecasts, declining -3.3% from a year ago, after avoiding the global market declines over the past five quarters. Soft retail demand, short term weakness from inventory reductions, some cannibalization from competing devices, and low demand for large commercial refreshes are among the factors that reduced PC shipments,” says Rajani Singh, IDC Senior Research Analyst, Personal Computers. “Nevertheless, moving forward, we expect a healthy second half as inventory and purchase decisions pick up following the launch of Windows 10. Emerging product categories will remain a bright spot as attention shifts to convertibles and [Google] Chromebooks in the commercial as well as consumer segments.”