Days Of Double Digit Smartphone Market Growth Are Behind Us

According to a paper published today by Kantar Worldpanel ComTech, mobile penetration in the US and Europe’s Big Five Countries (EU5) has reached 91%, while in urban China, that metric has risen to 97%. Ergo: nearly everyone now has a mobile phone, and if those numbers are not staggering enough 65% of Americans, 74% of Europeans, and 72% of urban Chinese consumers own a smartphone.

“With this kind of market penetration already in place, some in the industry are wondering where future sales will come from,” observes Carolina Milanesi, chief of research at Kantar Worldpanel ComTech, one of the paper’s coauthors. As is often the case, the answer depends on how you look at it.

During 2016, Ms. Milanesi estimates, smartphone sales will be largely based on:

– Convincing die-hard feature phone users that they need a smartphone

– Persuading smartphone owners that they want and need the next big thing

She projects that changes in smartphone OS market share, along with sales for the two top smartphone brands (Apple and Samsung), will come mainly from convincing users to switch from the competition.

“Many feature phone owners simply do not want a smartphone,” Ms. Milanesi adds. “Price is the biggest hurdle in getting feature phone users to upgrade to a smartphone. In Germany, 79% of recent feature phone buyers spent less than Euro60 on their device, while just 19% of smartphone buyers spent that amount. Smartphone buyers spent a total average of Euro276, while feature phone buyers spent an average of only Euro57.”

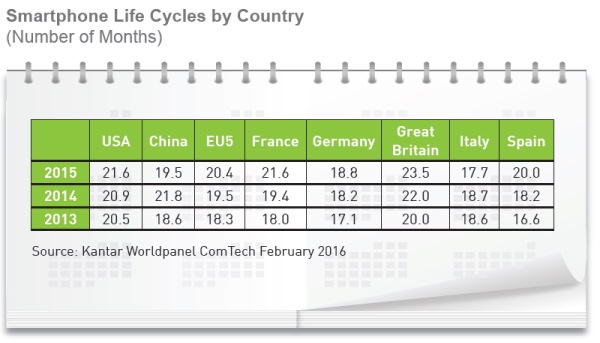

Kantar Worldpanel ComTech found that feature phone owners across markets are challenged in finding smartphones that offer what they consider good value for money spent, and are unlikely to upgrade to a smartphone until they can no longer rely on their current device. While looking year over year might not be enough to discern a clear trend, examining the past three years makes it clear that smartphone life cycles are getting longer, the analysts observe, noting that in mature markets, the profitable high end of the market is saturated. In the US, the high-end segment, devices with an unsubsidized price of more than $500 represented 48% of sales in 2015, growing a mere 9% over 2014. In the EU5, where the high-end segment represented just 27% of sales, growth was commensurately lower than in the US, coming in at 6%.

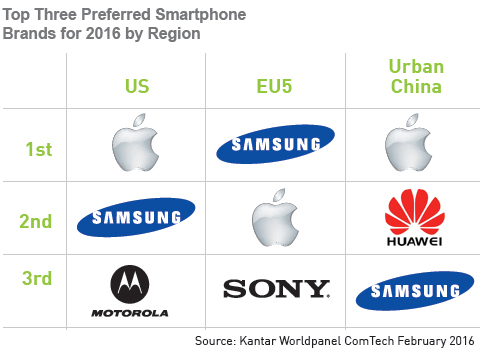

What should the industry expect for 2016? According to Ms. Milanesi, 48% of smartphone owners in the EU5 are currently planning to upgrade their smartphone over the next 12 months. This number decreases to 46% in the US, and 28% in urban China. Consumer brand preference for their next device varies a little by region, but two brand names that remain prominent are Apple and Samsung.

Top Smartphone Brands by Region

In the US, 40% of consumers planning to change their device prefer Apple, and another 35% prefer Samsung. Then, there is a large gap before we get to Motorola (6% preference) and LG (5%). In the EU5, the leadership position among preferred brands is reversed, with Samsung at 37% and Apple at 29%, Ms. Milanesi reports.

For the foreseeable future, MS. Milanesi believes, the smartphone will remain the device around which millions of people organize their lives. With market saturation, there are no longer hundreds of millions shopping for a first smartphone, but there are hundreds of millions who will carry smartphones everywhere they go.

“The smartphone market will never again see the growth of the past ten years. But, the opportunities to monetize from what has already been built are there, for those with the vision to find and seize them,” Ms. Milanesi says.

You can check out Kantar Worldpanel ComTech’s interactive OS Market Share dataviz with historical data here:

http://www.kantarworldpanel.com/global/smartphone-os-market-share/intro