Worldwide Tablet Market Decline Continues, Apple Still Leads, In Evolving Vendor Landscape – IDC

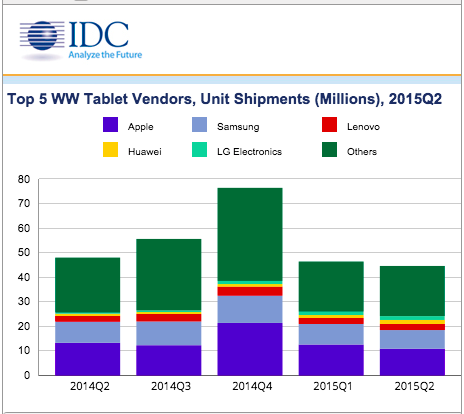

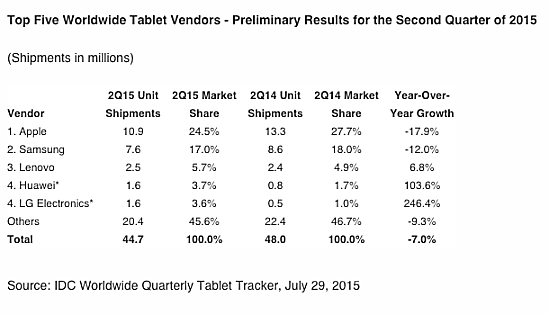

The worldwide tablet market declined -7.0% year-over-year in the second quarter of 2015 (2Q15) with shipments totaling 44.7 million units according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker. Marked by little hardware innovation and limited vendor portfolio updates, the market also declined -3.9% compared to the first quarter of 2015.

“Beyond the decline, we’re seeing a profound shift in the vendor landscape as the top two vendors, Apple and Samsung, lose share in the overall market,” comments Jean Philippe Bouchard, IDC Research Director for Tablets. “In the first quarter of the year, Apple and Samsung accounted for 45% of the market and this quarter, with the growth of vendors like LG, Huawei, and E FUN, their combined share dropped to 41%. Each of the growing vendors managed to address available pockets of growth in the market; connected tablets for LG and Huawei, larger tablets and 2-in-1s in the right price bands for E FUN. This trend is also something we see on a wider scale with the top 5 vendors accounting for 54% of the market, down from 58% last quarter. It is worth mentioning that Huawei enters the top 5 ranking for the first time, while E FUN has re-entered the top 10 after more than a year, further indicating that the vendor landscape is indeed evolving.”

Despite a continued decline in shipments for its iPad product line, Apple maintained its lead in the worldwide tablet market, shipping 10.9 million units in the second quarter. Samsung held its number 2 position in the market with 7.6 million units shipped and 17.0% market share in 2Q15. Lenovo maintained its third position with 2.5 million units and 5.7% share of the market. LG and Huawei ended the quarter in a statistical tie* for fourth place, rounding out the top 5 with each shipping 1.6 million devices. As previously mentioned, share outside the top 5 continued to outgrow the market, representing 46% of total tablet shipments in 2Q15.

“Longer life cycles, increased competition from other categories such as larger smartphones, combined with the fact that end users can install the latest operating systems on their older tablets has stifled the initial enthusiasm for these devices in the consumer market,” says Jitesh Ubrani, Senior Research Analyst, Worldwide Mobile Device Trackers. “But with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum.”

Notes:

Total tablet market includes slate tablets plus 2-in-1 tablets. References to “tablets” in this release include both slate tablets and 2-in-1 devices.

* IDC declares a statistical tie in the worldwide tablet market when there is less than 0.1% difference in the market share (based on shipments) of two or more vendors.

For more information, visit:

http://www.idc.com

Source: IDC