Global Smartphone Market Posts 11.6% Year-Over-Year Growth in Q2 2015 – Second Highest Ever

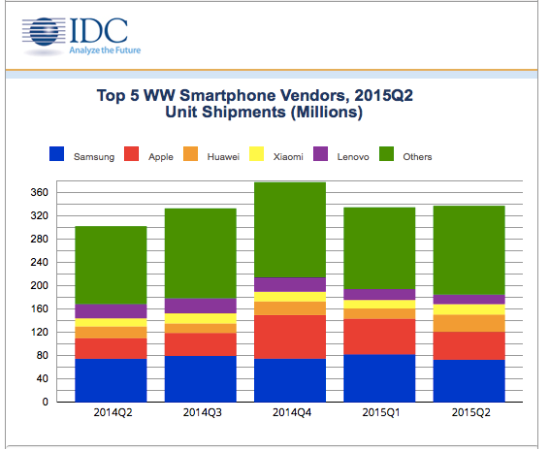

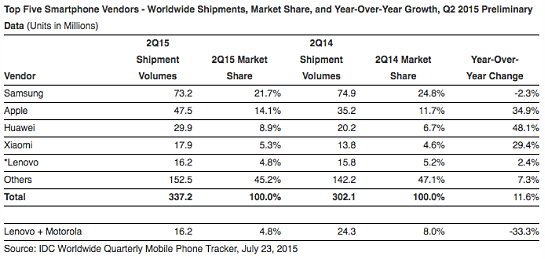

According to the latest preliminary data released from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, smartphone vendors shipped a total of 337.2 million units worldwide in the second quarter of 2015 (2Q15), up 11.6 percent from the 302.1 million units in 2Q14. The 2Q15 shipment volume represents the second highest quarterly total on record, and following an above average first quarter (1Q15), smartphone shipments were still able to remain slightly above the previous quarter sequentially thanks to robust growth in many emerging markets. In the worldwide mobile phone market (inclusive of flipphones as well as smartphones), vendors shipped 464.6 million units, down -0.4% from the 466.3 million units shipped 2Q14.

“The overall growth of the smartphone market was not only driven by the success of premium flagship devices from Samsung, Apple, and others, but more importantly by the abundance of affordable handsets that continue to drive shipments in many key markets,” says Anthony Scarsella, Research Manager with IDC’s Mobile Phone team. Although premium handsets sold briskly in developed markets, it was emerging markets, supported by local vendors, driving the momentum that heavily contributed to the second highest quarter of shipments on record. “As feature phone shipments continue to decrease, vendors will continue to attack both emerging and developed markets with competitive smartphones that are both rich in features and low in price,” Mr. Scarsella adds.

“While much of the attention is being paid to Apple and Samsung in the top tier, the smartphone market in fact continues to diversify as more entrants hit this increasingly competitive market,” says Melissa Chau, Senior Research Manager with IDC’s Mobile Phone team. “While the Chinese players are clearly making gains this quarter, every quarter sees new brands joining the market. IDC now tracks over 200 different smartphone brands globally, many of them focused on entry level and mid-range models, and most with a regional or even single-country focus.”

Smartphone Vendor Highlights:

Samsung remained the leader in the worldwide smartphone market but was the only company among the top five to see its shipment volume decline year over year. The new Galaxy S6 and S6 edge arrived with mixed results as a limited supply of the edge models did not keep pace with the demand for the new curved handset. Older Galaxy models, however, sold briskly thanks to deep discounts and promotions throughout the quarter. IDC says all eyes will now be on the early release of the pending Note 5 and rumored S6 edge plus to come this August.

Meanwhile, Apple’s second calendar quarter (which is the company’s fiscal Q3) proved to be its biggest fiscal third quarter ever with 47.5 million units shipped. The iPhone once again continued to dominate in China where shipments remained buoyant after a strong first quarter. The larger screened iPhones and iPhone 6 Plus phablet, along with the rapid expansion of 4G networks in China, continued to drive momentum for Apple in Asia/Pacific. As smartphone saturation continues to climb in many new developed markets like China, Apple will look to drive upgrades with refreshed “S” models in the next quarter.

Huawei captured the number 3 position thanks to strong European sales as well as domestic sales that led to a staggering 48.1% year-over-year growth. Huawei’s mid-range and high-end models continue to prove successful with the flagship P8, Honor Series, and Mate 7 handsets delivering sustainable growth both in the consumer and commercial segment. Huawei will now look beyond Europe and Asia/Pacifc as its latest P8 Lite handset launched in the U.S. (as an unlocked model) for only $250 earlier in the quarter.

Xiaomi continues to find success in its home country thanks to both premium and entry-level devices like the Mi Note and Redmi 2 handsets, which helped Xiaomi achieve a 29.7% year-over-year increase. With a significant presence in India and Southeast Asia, Xiaomi is now looking to bulk up its IP portfolio to expand its reach even further outside of Asia/Pacific, starting with Brazil.

Lenovo, the third and final Chinese OEM on the top five list, captured the final spot despite steep home turf competition from both Xiaomi and Huawei. Outside of China, Lenovo continued to enjoy success in many emerging markets such as India with entry-level and mid-range models like the A600 and A7000, sold via Internet retail channels. The Motorola brand within the Americas and Europe continues to thrive with the ultra-affordable second generation Moto E and entry-level to mid-range Moto G devices. IDC says pending launches of a third generation Moto X and Moto G look to be on the horizon for the second half of 2015.

Source: IDC Worldwide Quarterly Mobile Phone Tracker, July 23, 2015

Table Notes:

Data is preliminary and subject to change.

Vendor shipments are branded device shipments and exclude OEM sales for all vendors.

The “Vendor” represents the current parent company (or holding company) for all brands owned and operated as subsidiary.

For year-over-year comparison, an extra line has been added below the quarterly and annual tables to show what Lenovo’s growth would have looked like had its acquisition of Motorola been completed prior to the start of 4Q2014.

For more information, visit:

http://www.idc.com

Source: IDC Worldwide Quarterly Mobile Phone Tracker