Tablet Shipments To See First On-year Decline In 2014; Notebook Market Expected To Rebound – TrendForce

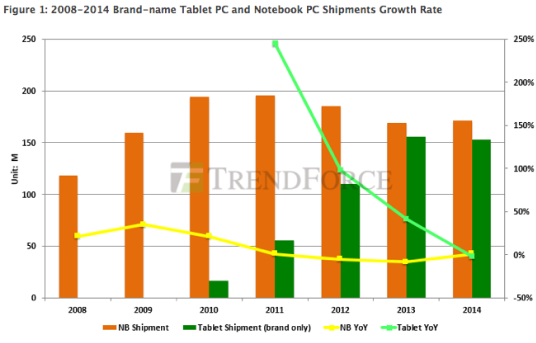

TrendForce analyst Caroline Chen notes that when the iPad launched in 2010, it was an instant hit and spurred a tablet PC revolution, with tablets so popular that that notebook PC sales stagnated and eventually began to fall as consumers increasingly switched to tablets.

MS. Chen observes that tablets have been revolutionary in the sense that they created demand for a new product category – one that competes fiercely with now virtually extinct netbooks and regular notebook PCs. However in 2014, their novelty seems to have worn off, prices have bottomed out, and low-price notebooks are clawing back market share.

“As a result, branded tablets will experience negative growth for the first time this year,” says Ms. Chen, a notebook PC analyst with the Taiwan-based market intelligence firm. MS. Chen expects 153 million brand-name tablets will ship in 2014, a year-over-year decrease of 1.8% percent. Notebook shipments, on the other hand, will increase 1 percent on year to 171 million, she predicts.

“With the tablet supply chain mature and shipments growing fast, the retail price of tablets has fallen sharply,” Ms. Chen says. “As a result, among all producers besides Apple, there will be a long-term price war in the tablet market,” she anticipates, predicting that Apple will merely release a revised version of its iPad Air in the second half of the year. Meanwhile, Samsung, another major player in the market, has only equipped high-end tablets under its own brand with its OLED screens, suggesting that the tablet market is flagging. TrendForce data back up that assertion. The data show that while tablet shipments will rise in the second half of the year, the main reason that increase appears substantial is that shipments in the first half were so low.

At the same time, because of rising demand for tablet PCs and the rapid decline in the retail price of standard notebooks, the market for netbooks has almost vanished. By contrast, demand for notebook PCs has started to rebound. “Time has shown that notebooks are irreplaceable,” says Ms. Chen. “They offer larger screens than tablets as well as a keyboard and mouse, which are all important for those who use their computers primarily for work reasons. Tablets remain limited to Internet browsing and entertainment functions.”

TrendForce believes notebook shipments will increase in the second half of the year for several reasons. First, with the tablet market flagging, they face fewer threats. Second, demand for notebooks in the commercial market remains. Finally, notebooks are priced very competitively. All of these factors will contribute to boost notebook demand, giving brand-name manufacturers such as Hewlett-Packard (HP), Lenovo and others room to grow that side of their businesses. As such, TrendForce estimates the global notebook PC market has the potential to expand 4-7% in the second half of the year, making 2014 the year when slowing notebook demand may finally reverse.

For more detailed information on tablet and notebook reports, refer to the “WitsView Monthly Mobile PC ODM Shipment Tracker” and “T5. WitsView Monthly Tablet Panel and Touch Module Price Book.”

For more information, visit:

http://www.trendforce.com/