Smartphone Outlook Remains Strong for 2014, Up 23.8%, Despite Slowing Growth in Mature Markets – IDC

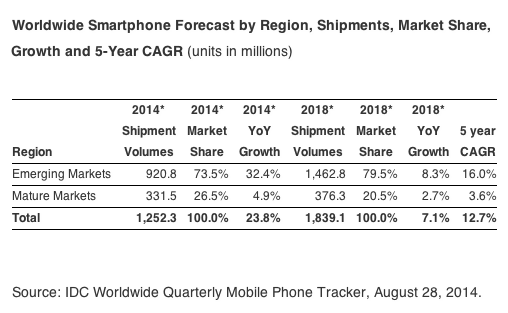

According to a new mobile phone forecast from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, more than 1.25 billion smartphones will be shipped worldwide in 2014, representing a 23.8% increase from the 1.01 billion units shipped in 2013. Looking ahead, total volumes are forecast to reach 1.8 billion units in 2018, resulting in a 12.7% compound annual growth rate (CAGR) for the 2013 – 2018 forecast period.

Emerging markets have accounted for more than 50% annual smartphone shipments dating back to 2011, so it is no question that they have been crucial to the growth of the overall market. However, up until 2014, mature markets have consistently delivered double-digit year-on-year growth. In 2014, IDC expects mature markets will slow to just 4.9% growth, with emerging markets continuing to soar at 32.4%, pushing the total market up 23.8%.

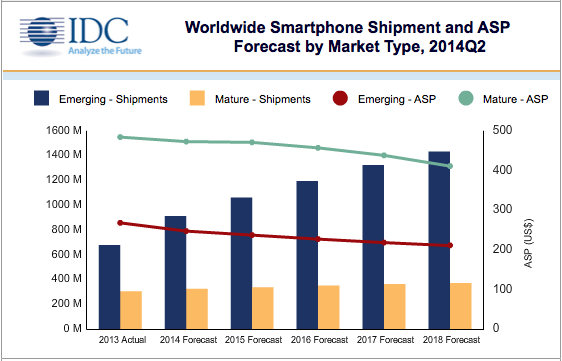

“The smartphone market, which has experienced runaway growth over the last several years, is starting to slow. Mature markets have slowed considerably but still deliver strong revenues with average selling prices (ASPs) over US$400. Meanwhile, many emerging markets are still barreling along, but with ASPs of less than US$250,” said Ramon Llamas, Research Manager with IDC’s Mobile Phone team. “The key for vendors now is to maintain a presence in the higher-margin mature markets, while establishing a sustainable presence within the fast-growing emerging markets. To enable this strategy, operating system companies are partnering with OEMs to provide low-cost handsets.”

In 2014, IDC expects emerging market smartphone volume to grow to 920.8 million units accounting for 73.5% of all volume shipped. The catalyst here continues to be Android devices, which are expected to account for 88.4% of this volume. IDC’s outlook for emerging market smartphone volume is 1.4 billion units by 2018, growing to 79.5% of worldwide volume.

“The support that Google’s Android platform has received from over 150 handset manufacturers has allowed it to gain the share it has in emerging markets,” says Ryan Reith, Program Director with IDC’s Worldwide Quarterly Mobile Phone Tracker. “The lack of constraints around hardware and software specifications has helped bring to market many low-cost products, a lot of which could be considered borderline junk. With Google’s recent announcement of Android One, they hope to change this by laying out a set of standards for manufacturers to follow.”

The other widely discussed trend has been the shift towards large screen smartphones. IDC expects “phablets” (smartphones with 5.5″ – 7″ screens) to grow from 14.0% of the market in 2014 to 32.2% of the market in 2018. With the expected entry of Apple into this market segment, and the pent-up demand for a larger screen iPhone, Apple has the ability to drive replacement cycles in mature markets despite the slower growth seen in recent quarters.

* forecast data

Table Note: Mature Markets include U.S., Western Europe, Japan, and Canada. Emerging Markets includes Asia/Pacific (excluding Japan), Latin America, Central and Eastern Europe, Middle East, and Africa.

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

For more information, visit:

http://www.idc.com